The second quarter of the year ended in the name of stability for the majority of the manufacturers of wire and metal cable machines but, in comparison with the previous survey, it grows the percentage of enterprises that record a rising trend. The phone survey, carried out by “Tecnologie del Filo” on the whole universe of Acimaf members, highlights that 60 percent of organizations maintain the turnover levels reached in the previous quarter while 23 percent assess a turnover development. Moreover, in comparison with the last quarter, the fraction of enterprises that report an unsatisfactory trend decreases and drops from 27 to 17 percent.

If we extend the comparison to last year, we can notice that the distribution of the percentage frequency of assessments shows limited variations and that the amplitude deviations of subsamples remain in the order of the physiological statistical error, not highlighting the incidence of errors connected with seasonality.

Such verification induces to hypothesize, on one hand, that the judgements about the business performance are conditioned by the competitive positioning assumed by single players and, on the other hand, that the different market segments are characterized by specific marketing dynamics that are not synchronous from the time point of view. That hypothesis is supported by the analysis of the answers given by the sample about the production trend. The percentage of enterprises that complain a productive loss, in fact, amounts to 13 percent, four points less than that denouncing a profit downturn. It is necessary to observe that such partition is reduced in comparison with the previous surveys, in which it was constantly stable, and that the group of realities with expanding production volumes, which had reached 27 percent, holds, on the contrary, the identical width as that recorded in the last editions of the survey. The trend of orders seems to indicate a general improvement of the situation. Concerning the period under observation, 40 percent of players declare that they have recorded a growth of job orders, 42 percent that they have equalled the entity of volumes achieved in the previous quarter and 29 percent that they have been affected by a decrease. In short, it seems that the downturn occurred at the beginning of the year has been recovered and we can observe that the group of subjects that refer an order rise is slowly but constantly widening, while the one composed by entrepreneurs who complain a negative trend is decreasing. In quantitative terms, the first shows a growth by over six percentage points compared to the average of the last twelve months, the second highlights a decrease that can be estimated by around four points.

Such verification induces to hypothesize, on one hand, that the judgements about the business performance are conditioned by the competitive positioning assumed by single players and, on the other hand, that the different market segments are characterized by specific marketing dynamics that are not synchronous from the time point of view. That hypothesis is supported by the analysis of the answers given by the sample about the production trend. The percentage of enterprises that complain a productive loss, in fact, amounts to 13 percent, four points less than that denouncing a profit downturn. It is necessary to observe that such partition is reduced in comparison with the previous surveys, in which it was constantly stable, and that the group of realities with expanding production volumes, which had reached 27 percent, holds, on the contrary, the identical width as that recorded in the last editions of the survey. The trend of orders seems to indicate a general improvement of the situation. Concerning the period under observation, 40 percent of players declare that they have recorded a growth of job orders, 42 percent that they have equalled the entity of volumes achieved in the previous quarter and 29 percent that they have been affected by a decrease. In short, it seems that the downturn occurred at the beginning of the year has been recovered and we can observe that the group of subjects that refer an order rise is slowly but constantly widening, while the one composed by entrepreneurs who complain a negative trend is decreasing. In quantitative terms, the first shows a growth by over six percentage points compared to the average of the last twelve months, the second highlights a decrease that can be estimated by around four points.

The phenomenon can be ascribable to the intersection of numerous contributory causes but it seems related to the bent for export and to the coverage of the specific international markets by companies as well as by the penetration degree obtained locally. The home market, in fact, does not seem to show recovery signs: the percentage frequency distribution of the indications provided by interviewees, even if with slight deviations, seems to be anchored to the pattern of the minimum levels reached last year.

The phenomenon can be ascribable to the intersection of numerous contributory causes but it seems related to the bent for export and to the coverage of the specific international markets by companies as well as by the penetration degree obtained locally. The home market, in fact, does not seem to show recovery signs: the percentage frequency distribution of the indications provided by interviewees, even if with slight deviations, seems to be anchored to the pattern of the minimum levels reached last year.

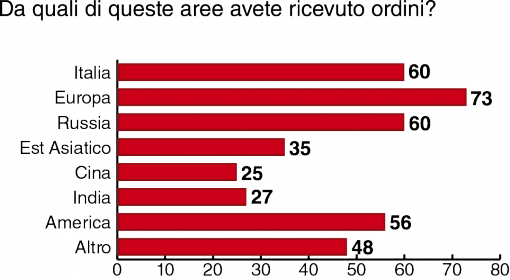

Since the entity of the acquired orders remains stable and the demand for estimates tends to decrease, it is not licit to formulate optimistic forecasts about a revival of the demand in short times, unless the Government finally succeeds in launching some effective boosting incentives for the economic system. Export performances seem more satisfactory, even if well differentiated according to the geographical area. The percentage of operators who have received orders from Europe is decreasing if compared with the previous quarter and, mirroring the slowdown of the economy of some Countries, passes from 78 to 73 percent. On the contrary, an increase is scored by the number of subjects who refer to have fulfilled sales on extra-continental markets. In particular, it is worth signalling the positive developments achieved in the Russia area (+ 13 %) and in America (+ 9 %). China, India and East Asia, on the other hand, have generated a turnover that mirrors the previous quarter, even if decreasing when compared to the same period of last year.

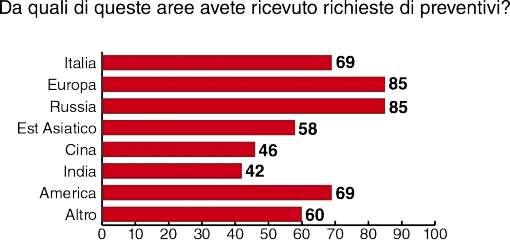

Quite conspicuous is the flow of estimate demands from abroad: the interest of European, American and Chinese customers appears stable, while it seems rising the one coming from users located in Russia, India and East Asia. The datum looks encouraging but it must be read with prudence because the export slowdown of rising Countries can curb or condition an investment postponement.

Against the scenario just described, Italian producers are called to express the highest flexibility in commercial strategies and to calibrate in optimal way their marketing efforts, in order to confirm the leadership role that competes to them for quality, technology and innovation capability.

Roberto Morelli with the collaboration of ACIMAF members