A fair optimism characterizes the evaluations of the producers of machines for metal wire and cable about the trend of the last 2013 quarter.

The analysis of the answers given by the sample of Acimaf member entrepreneurs, sample that by extraction wideness and modality ranks as representative of the whole industrial sector, witnesses a remarkable trend improvement, both in comparison with the previous quarter and the same 2102 period.

The analysis of the answers given by the sample of Acimaf member entrepreneurs, sample that by extraction wideness and modality ranks as representative of the whole industrial sector, witnesses a remarkable trend improvement, both in comparison with the previous quarter and the same 2102 period.

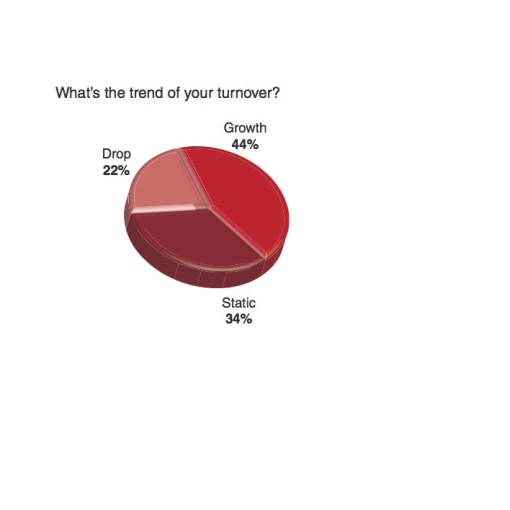

44 percent of interviewees, in fact, state that they have achieved a turnover rise in the examined period, while 34 percent deem their turnover stable.

In comparison with the survey carried out last October, the percentage of players declaring a revenue increase has grown by seventeen percentage points and, at the same time, the fraction of those that consider the revenue entity unchanged has dropped from 49 to 34 percent.

It is worth underlining, on the other hand, that the percentage of manufacturers complaining about sale shrinkage shows very modest variations in time, reaches 22 % in the last survey and amounted to an analogue figure in the previous ones.

The reasons for such a phenomenon deserve a thorough analysis, in order to clarify whether it is connected with the continuing of reflexive dynamics in specific market segments or it derives from the competitive positioning taken by the players or the unsatisfactory performance depends on factors ascribable to the structural/organizational characteristics of companies themselves.

It would be necessary to investigate on such aspects to remedy them and to identify the suitable marketing strategies for promoting the competitiveness of one of the sectors of the national industry boasting the highest technological innovation because this, maximising its internal synergies, can further strengthen the success and the prestige enjoyed on a global scale.

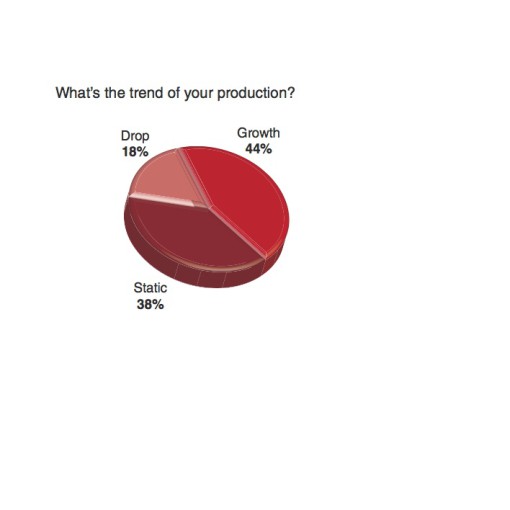

The answers given by the sample about the production describe an identical scenario and prove the existence of a nucleus of enterprises that are still affected by the crisis effects and are late in recovering: the cases in which a drop of productive volumes occurs amount to 18 percent, slightly inferior fraction to that calculated in the third quarter, but essentially unchanged in comparison with the previous year.

The answers given by the sample about the production describe an identical scenario and prove the existence of a nucleus of enterprises that are still affected by the crisis effects and are late in recovering: the cases in which a drop of productive volumes occurs amount to 18 percent, slightly inferior fraction to that calculated in the third quarter, but essentially unchanged in comparison with the previous year.

On the contrary, it is considerably expanding the group that scores a positive result because the data collected on the field highlight that the output of production processes shows a rise in 44 percent of companies, growing percentage by a good thirteen points compared to that measured in September.

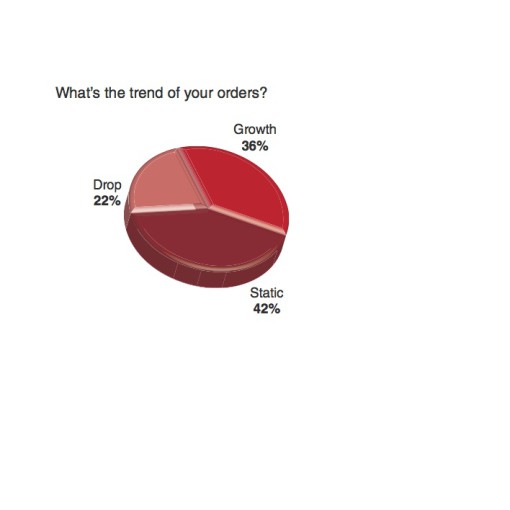

Also the order tendency seems to indicate a favourable evolution of the market trend.

36 percent of interviewees state that they have received a higher quantity of orders in comparison with the third quarter, 42 percent affirm that the value of job orders equals the one developed in the antecedent period and 22 percent complain that they have registered a downturn. In the research carried out at the beginning of October, the sample was subdivided into percentages respectively corresponding to 31, 41 and 27 percent.

36 percent of interviewees state that they have received a higher quantity of orders in comparison with the third quarter, 42 percent affirm that the value of job orders equals the one developed in the antecedent period and 22 percent complain that they have registered a downturn. In the research carried out at the beginning of October, the sample was subdivided into percentages respectively corresponding to 31, 41 and 27 percent.

The number of subjects reporting a positive business development highlights, therefore, the 5% growth and the reduction value of those signalling a downturn is the same.

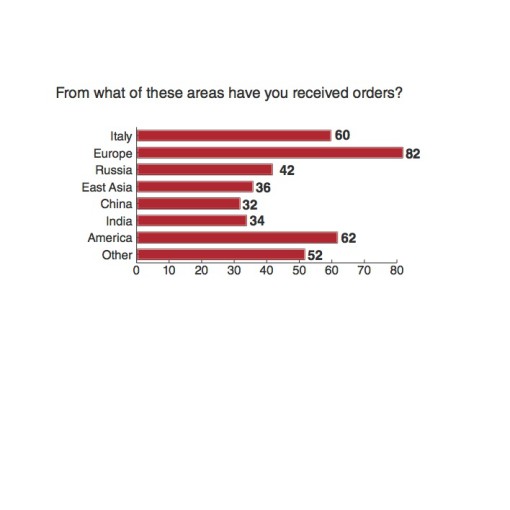

Job orders mainly come from international markets. The share of entrepreneurs stating that they have acquired orders from Italy amounts to 60 percent and, in comparison with the third quarter, is lower by seven points. Processing, by historical series, the answers given by manufacturers in the course of the last two years, it is highlighted that the home demand shows an irregular trend and alternates progresses and setbacks that are not easily foreseeable or framed into seasonality cycles. In short, the long recession phase seems to have determined a particular volatility that risks of becoming a stable and problematic characteristic of the national market.

In the observation period, on the contrary, the flow of orders from abroad scores an expansion: 82 percent of the surveyed entrepreneurs have achieved sales in Europe and 62 percent in America. In constant growth seems the penetration in Russia (42%), which ranks as the third outlet area of domestic brands. The made in Italy attains a significant success in China and India because the percentage of players that declare having fulfilled transactions in those areas respectively reaches 32 and 34 percent and grows by about ten percentage points with regard to the previous quarter.

In the observation period, on the contrary, the flow of orders from abroad scores an expansion: 82 percent of the surveyed entrepreneurs have achieved sales in Europe and 62 percent in America. In constant growth seems the penetration in Russia (42%), which ranks as the third outlet area of domestic brands. The made in Italy attains a significant success in China and India because the percentage of players that declare having fulfilled transactions in those areas respectively reaches 32 and 34 percent and grows by about ten percentage points with regard to the previous quarter.

Besides, positive outcomes have been obtained by the sale efforts in East Asia and, more in general, in the whole global scenario.

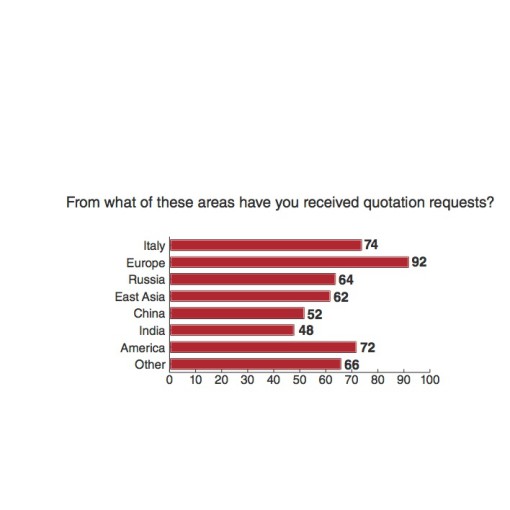

The influx of quotation requests appears high, nourishes good hopes and lets us forebode that the favourable trend surveyed on a global scale is going to continue in the next months.

The interest of European, Indian and Far East users is in fact getting stronger while that of American and Chinese users is stable. A moderate slowdown seems to hit the Russian market, since it is decreasing, and the percentages of manufacturers that have started new contacts in that area drops from 71 to 64%.

It is worth noticing the constant rise of the percentage of interviewee who declare that they have established relationships in geographical areas classified under the item “Other”, that’s to say different from the traditionally more consolidated markets: the datum witnesses the total bent of Italian enterprises for operating in the global arena and their attitude to seizing opportunities wherever they arise, timely and fully satisfactorily meeting very user typologies that differ by needs, expectations, behaviour modalities, mentality and culture.

It is worth noticing the constant rise of the percentage of interviewee who declare that they have established relationships in geographical areas classified under the item “Other”, that’s to say different from the traditionally more consolidated markets: the datum witnesses the total bent of Italian enterprises for operating in the global arena and their attitude to seizing opportunities wherever they arise, timely and fully satisfactorily meeting very user typologies that differ by needs, expectations, behaviour modalities, mentality and culture.

Only the Italian market, unfortunately, sends scarcely encouraging signals and users’ investment intentions seem to fade because, in the opinion of the sampled entrepreneurs, after some months characterized by more liveliness, the quotation demands seem to decrease.